Housing

Overview

During the past three decades, many families have chosen to leave densely populated cities to live in suburban neighborhoods that offer spacious homes with backyards, quality schools, and – above all – a peaceful environment absent of the constant noise of sirens, car horns, and people. Millennials and Generation Z are beginning to find themselves priced out of the housing market in urban centers, creating a greater demand for housing in suburbs and micropolitan areas. Baby Boomers are selling their homes so they can downsize. What all of these groups have in common is the desire to live in appropriately sized houses, apartments, or condos near the amenities they regularly frequent and those they enjoy socially for entertainment. Small cities, like West Monroe, have the opportunity to build the housing stock and amenities that will attract these people to live in and around the downtown area.

As the data indicates, many of these people already live in the region but they need more options – homes/condos for sale, apartments for rent, upper story housing, housing with a riverfront view, etc. To address the housing market in downtown West Monroe, Alchemy assessed existing conditions, identified development challenges, and created strategies to strengthen local housing stock.

Challenges

According to feedback from locals and insight from realtors, existing housing stock in and around downtown is in limited supply due to low vacancy rates and a lack of housing options. Riverfront condos and downtown apartments typically house singles, young couples (without children), and seniors who downsized from single-family homes. Recent housing developments downtown include the Hatchell Building Apartments (work-live lofts) and Myrtlewood Cottages (small homes) which have diversified available offerings both in price and design, but are almost fully occupied at any given time. This is true of most of the housing options in the downtown area which demonstrates the demand for more housing development, especially as more restaurants, retail, and other cultural amenities begin to emerge in West Monroe.

Since public infrastructure in downtown West Monroe is approximately 80-100(+) years old, developers seeking to revitalize existing buildings or invest in new construction might be financially inhibited from proceeding with their proposed projects with the added expense of improving public infrastructure for the benefit of their commercial or residential development. Additionally, the average age of the buildings located downtown is 85 years old which requires a more substantial capital investment to rehabilitate, upgrade, preserve, and maintain these buildings.

According to the U.S. Department of Housing and Urban Development’s Office of Policy and Research, “neighborhood blight and the presence of abandoned properties have profound negative impacts on afflicted communities. Blighted properties decrease surrounding property values, erode the health of local housing markets, pose safety hazards, and reduce local tax revenue.” Blighted properties are more than an eyesore and make people feel less safe whether or not crime actually occurs more frequently in these neighborhoods. Additionally, when neighborhoods become less attractive and are perceived to be unsafe, prospective buyers are less likely to purchase homes in these areas fueling further population loss and economic disinvestment. For West Monroe, blighted and/or abandoned properties in and around downtown are reducing local tax revenue making it more costly for the city to provide public services and other functions such as code enforcement, waste cleanup, police, and fire.

An analysis of West Monroe’s demographic and economic indicators demonstrates deep-rooted challenges for some residents who want to purchase a home. In some cases, prospective buyers have insufficient resources to afford a down payment or have difficulty qualifying for traditional financing from a bank. In other cases, homeowners become so cost-burdened by their mortgage payments that they are paying more than 30% of their monthly income for a singular fixed expense. In West Monroe, the median household income ($32,182) is substantially lower than Ouachita Parish ($40,081) and the state ($46,710) creating a barrier to homeownership for many without quality, high-paying jobs and making it more difficult for West Monroe to transition residents from rental units to owner-occupied housing.

Opportunities

Within 30 miles of West Monroe is the University of Louisiana Monroe, Louisiana Tech University, Grambling University, and Louisiana Delta Community College. Tens of thousands of young adults and non-traditional students residing in the region need housing they can afford during their time in college, graduate school, and once they graduate if they can find a job and afford to stay. Northeast Louisiana is predominantly rural and experiences “brain drain” when college-educated talent finds work elsewhere in Louisiana or out-of-state. But with job opportunities available in Ouachita Parish and nearby communities, West Monroe should continue developing modern housing options in and around downtown to lure recent college graduates and young singles/couples to live downtown near retail storefronts, local restaurants, and the Ouachita River. Sometimes this requires additional incentives such as cash to be used for rent/down payment and free gym membership or subsidized office space (for remote workers).

Examples of incentive programs like these include:

- Newton Housing Initiative | Newton, Iowa

- Remote Shoals | Colbert and Lauderdale counties, Alabama

- Tulsa Remote | Tulsa, Oklahoma

Although the development of owner-occupied units will undoubtedly increase foot traffic downtown, offering more locally-owned short-term rentals for business people, students, remote workers, and visitors needing a place to stay with more amenities and flexibility than a hotel will help local businesses and restaurants sustain extended operating hours and create the perception that downtown is the place to be during the weekdays, weekends, and all hours in between. Nowadays, people are staying in short-term rental units all over the world booking through companies such as Airbnb, VRBO, and HomeAway. While the goal is not to make downtown a destination for tourists and visitors alone, short-term rental units can provide a more unique experience than the alternative (i.e. a standard hotel) and can be modified for long-term renters and tourists passing through the area.

There are several programs at the state and federal levels that provide resources to help finance the construction of new and rehabilitation of existing housing developments as well as mortgage/rental assistance and other community housing projects. For example, through the State Community Development Block Grant Program, the U.S. Department of Housing and Urban Development provides funding for each state to allocate to non-entitlement areas (cities with populations of less than 50,000 and counties/parishes less than 200,000) to support rehabilitation of residential and non-residential structures, relocation and demolition, acquisition of real property and construction of or improvements to public facilities, among other things. Additionally, the Louisiana Housing Corporation administers a number of programs such as the Low-Income Housing Tax Credit Program and Multifamily Revenue Bonds to assist developers and home seekers alike in building/rehabilitating and maintaining quality places to live in Louisiana communities.

Development Strategies

As previously mentioned, more than half of the online survey participants responded favorably (‘yes’ or ‘maybe’) when asked if they would consider living in downtown West Monroe. Additionally, 56% of these survey respondents believe more ‘2nd-Story Condos/Apartments’ should be built downtown. Upper story housing in downtowns across the country has become more and more popular over the years and appeals to a variety of age groups — young singles and couples, middle-aged, and seniors — and is inclusive for people with varying levels of income. Downtown living is attractive for a number of reasons but many consider relocating due to the proximity to restaurants, retail stores, coffee shops, churches, and other amenities — especially if these amenities and services exist in a revitalized, walkable downtown. Recent upper story housing development in downtown has already proven to be successful with minimal vacancies, not to mention the affordability of living in West Monroe.

To incentivize more development in downtown, there are a few programs that property owners and prospective developers can use to rehabilitate existing buildings to increase the supply of upper-story housing including, but not limited to, the following:

The Restoration Tax Abatement (RTA) program provides an up-to ten-year abatement of property taxes (ad valorem) on renovations and improvements of existing commercial structures and owner-occupied residences located within economic development districts, downtown development districts, historic districts, and opportunity zones. RTA is available to all Louisiana businesses and homeowners with existing structures to be expanded, restored, improved or developed in qualifying locations and as approved by the local governing authority.

Eligible expenses:

- Building and materials

- Machinery and equipment (only that which becomes an integral part of the structure)

- Labor and engineering

- Non-eligible expenses:

- Acquisition cost of the structure or land

- Movable and personal property

For more information about the RTA program, visit www.opportunitylouisiana.com.

Created in 2002 by the Louisiana Legislature, the State Commercial Tax Credit program is designed to encourage the redevelopment of income-producing historic buildings located in Downtown Development Districts or certified Cultural Districts. Rehabilitation projects must exceed $10,000 in qualified rehabilitation expenses and must be completed according to the Secretary of the Interior’s Standards for Rehabilitation. Once earned, credits are fully transferable and may be carried forward for up to five years. Although the State Commercial Tax Credit program sunsets December 31, 2021, the credit is equal to 20% of eligible costs and expenses incurred January 1, 2018, or later, regardless of the year in which the property is placed in service.

For more information about the State Commercial Tax Credit program, visit www.crt.state.la.us.

Additionally, the Federal Historic Preservation Tax Incentives program offers a 20% income tax credit for the rehabilitation of historic, income-producing buildings that are determined by the Secretary of the Interior, through the National Park Service, to be “certified historic structures.” The tax credit is only available to properties rehabilitated for income-producing purposes including commercial, industrial, agricultural, rental residential, or apartment use. In general, only those costs that are directly related to the repair or improvement of structural and architectural features of the historic building will qualify.

For more information about the Federal Historic Preservation Tax Incentives program, visit www.nps.gov.

Combined, property owners and prospective developers seeking to rehabilitate historic, income-producing buildings downtown can combine state and federal tax credits to realize up to 40% of the total project development costs.

Blight Remediation

In a paper written by the Federal Reserve Bank of Atlanta, “blight” is defined as the proliferation of vacant, abandoned, or poorly maintained properties. Blight is a critical issue all communities face, regardless of size or location, and is associated with social, economic, environmental and public health effects on neighborhoods. Although the Great Recession of 2008 led to a surge of abandoned and bank-owned properties — especially in poor and unstable neighborhoods — many cities experience blight as a result of some combination of population decline, job losses, foreclosures, and natural events that render structures or lots unusable or too expensive to redevelop. Blighted properties have profound negative impacts on communities because they decrease surrounding property values, erode the health of local housing markets, pose safety hazards, and reduce local tax revenue. In the neighborhoods adjacent to downtown West Monroe, the presence of blighted properties exists for both owner-occupied and rental housing units that can be addressed with the creation of a revolving loan fund to target housing development/rehabilitation.

Revolving Loan Fund

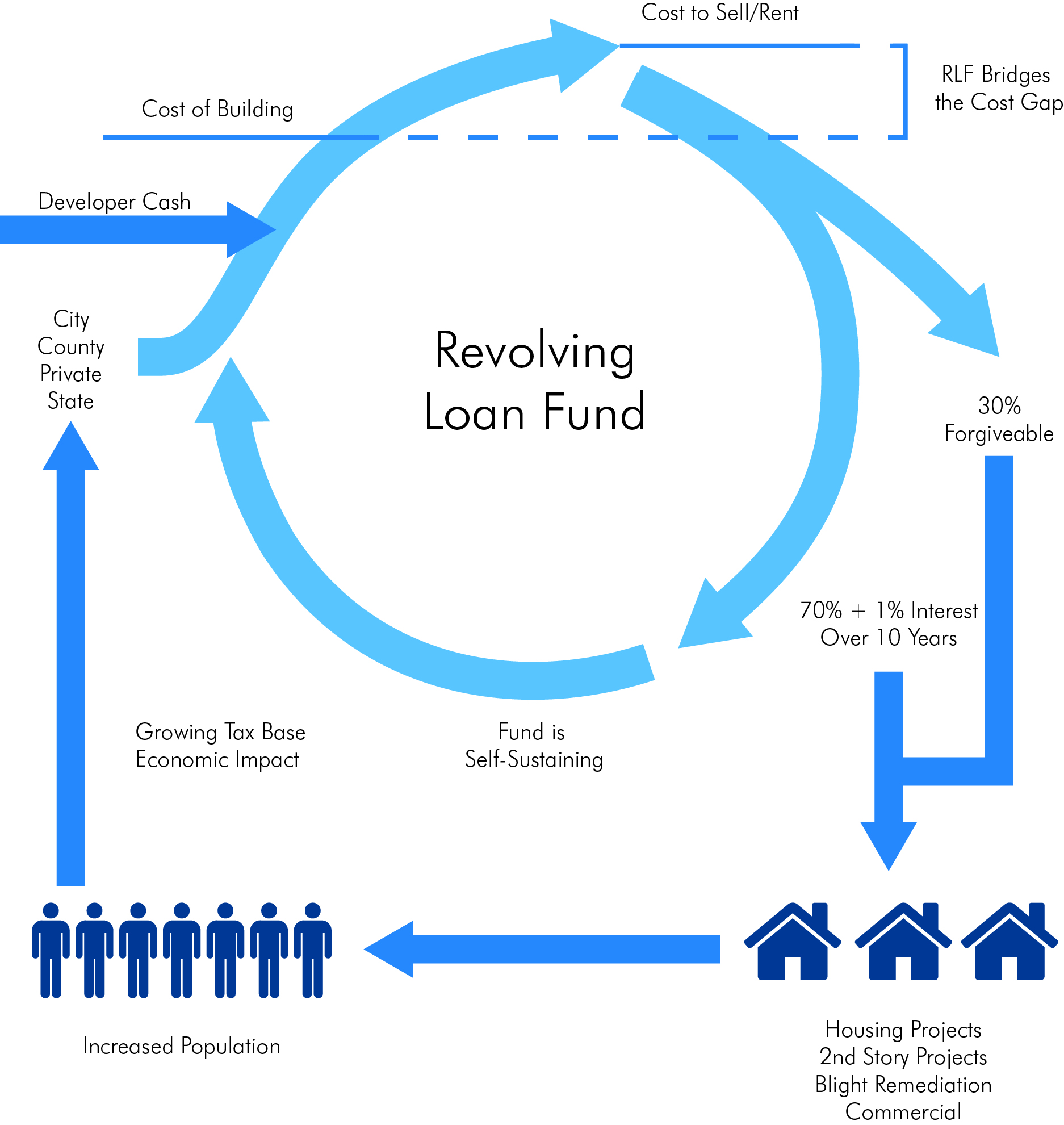

The Council of Development and Finance Agencies defines a revolving loan fund (RLF) as a gap financing measure primarily used for the development and expansion of small businesses. It is a self-replenishing pool of money, utilizing interest and principal payments on old loans to issue new ones. While the majority of RLFs support local businesses, some target specific areas such as healthcare, housing, and environmental cleanup.

Typical uses for RLF loans include:

- Operating capital

- Acquisition of land and buildings

- New construction

- Facade and building renovation

- Landscape property improvements

- Machinery and equipment

Quality RLFs issue loans at-market or otherwise competitive and attractive rates. That said, RLF programs should be built on sound interest rate practices and not perceived as free or easy sources of financing. RLFs must be able to generate enough of an interest rate return to replenish the fund for future loan allocations.

Loan terms vary according to the use of funds. A loan used for working capital, for instance, may range from 3 to 5 years, while loans for equipment are up to 10 years and real estate loans may last 15 to 20 years. It is important that terms are fixed to the useful life of the asset financed. Additionally, loan amounts range from small ($1,000 to $10,000) to mid-sized ($25,000 to $75,000), with larger ($100,000 to $250,000 and up) amounts available when the borrower has secured a substantial sum from private lenders.

Initial funding, or capitalization, of a revolving loan fund, usually comes from a combination of public sources, such as the local, state, and federal governments, and private ones like financial institutions and philanthropic organizations. Funding acquired for capitalization is usually the equivalent of a grant – it does not need to be paid back. Most revolving loan funds have at least one local public source for capitalization combined with other sources. If capitalization is exclusively local, the RLF may have greater flexibility in lending, as state and federal involvement tend to include restrictions that may not fit local business needs

To incentivize new housing development and rehabilitation of existing housing units, the City of West Monroe (or another public or private entity) can establish an RLF using both public and private monies.

Here’s how (and why) it can work:

Here’s an example scenario assuming an RLF total of $1 million:

- “Developer ABC” determines the cost to build new housing units is more expensive than the cost to sell, with a gap of $20,000 per unit for five (5) new housing units

- “Developer ABC” meets the pre-determined eligibility criteria to submit an application for RLF gap financing and requests $100,000 ($20k/unit for 5 new units)

- If “Developer ABC” agrees to begin construction within 6 months of receiving the RLF funding and commits to the project for a 10-year period, then:

- 70% of the funds will be a traditional loan with a 1% interest rate over 10 years

- 30% of the funds will become a forgivable loan (not repaid)

- If the housing development is sold before the 10-year period ends, “Developer ABC” will be responsible for paying back this portion of the loan with a 1% interest rate as well

RLF Funding Availability

| RLF Total | Traditional Loan (70%) | Forgivable Loan (30%) |

| $1,000,000 | $700,000 | $300,000 |

Developer ABC: RLF Loan Request

| RLF Total | Traditional Loan (70%) | Forgivable Loan (30%) |

| $100,000 | $70,000 | $30,000 |

Developer ABC: RLF Loan Repayment

| Total Loan | Traditional Loan (70%) | Interest Rate (1%) for 10 years | Loan + Interest | Forgivable Loan (30%) | Total Repayment |

| $100,000 | $70,000 | $7,000 | $77,000 | $30,000 | $77,000 |

Based on this example, the RLF provided “Developer ABC” with $100,000 to build five (5) new housing units. After the housing units were built and the developer remained with the project for 10 years, 30% ($30,000) of the initial loan was forgiven and 70% ($70,000) plus 1% interest ($7,000) was recouped to replenish the RLF. With this new development of five (5) new units, the rest of the loan ($23,000) will be recouped many more times over with the additional collection of property taxes and sales tax revenue generated by the new residents.